Welcome to the PRODIGO Capital Group website dedicated to investor relations. This area of service was created for our current investors.

The PRODIGO Capital Group owes its current position to, i.a., activities operations supported by investors, aimed at infrastructure development and acquisitions of entities from the industry. In order to put this into practice, Prodigo S.A. issued several series of shares and bonds allowing for the recapitalisation of projects. In addition, since 2013, selected companies, currently belonging to the holding, have carried out 44 bond issues for a total amount of over PLN 88.3 million, with nearly PLN 42.3 million in 24 series, whose capital has matured and been redeemed by the companies.

Bearing in mind the systematic support from investors expressed in their involvement in the issue of securities of the companies comprising the PRODIGO Capital Group, we make every effort to provide all interested parties with the fullest possible picture of our operations. To this end, we are developing tools and channels of communication with our investors, including:

- presentation of financial reports and information about our operations in the Investor section, available after logging in,

- preparation of periodic activity summaries,

- ongoing correspondence concerning investments in entities of the PRODIGO Capital Group,

- access to our Investor Relations Department in case of any questions.

We believe that transparency in communication and easy access to information concerning the companies of the PRODIGO Capital Group will contribute to maintaining and developing relations with our investors.

We encourage you to familiarize yourself with the basic information about the PRODIGO CG and subsidiaries, as well as the detailed data contained in periodic reports as well as presentations and summaries that we have prepared especially for our Investors.

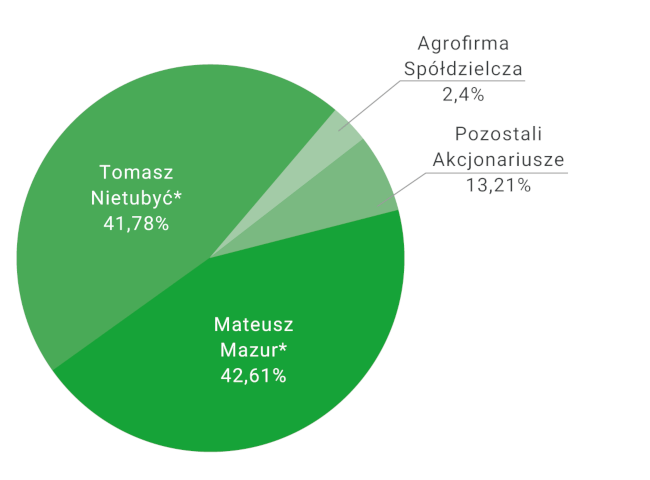

Shareholding Prodigo S.A.

|

Head office: Wrocław Share capital: PLN 255.4 million It is divided into 2.55 billion A-UU series shares with a value of PLN 0.10 each |

* directly and through the company Prodigo Odlewnia sp.z o.o.

Materials for investors

We invite you to familiarize yourself with detailed information about companies from the PRODIGO Group

PRODIGO GK STRATEGIC SUMMARY 2014-2018

PRODIGO GROUP - activity report for the first quarter of 2019

PRODIGO folder - 2017

Corporate governance

Prodigo sp. z o.o.

Prodigo sp.z o.o. company agreement

Prodigo sp. z o.o. KRS

Prodigo sp. z o.o. NIP

Prodigo sp. z o.o. REGON

Cemenergy sp. z o.o.

Prodigo Metals Recovery sp. z o.o.

Prodigo Metals Recovery sp. z o.o. company agreement

Prodigo Metals Recovery sp. z o.o. KRS

Prodigo Recykling sp. z o.o.

Prodigo Recykling sp. z o.o. company agreement

Prodigo Recykling sp. z o.o. KRS

Prodigo Recykling sp. z o.o. NIP

Prodigo Recykling sp. z o.o. REGON

AG Recykling sp. z o.o.

AG Recykling sp. z o.o. company agreement

AG Recykling sp. z o.o. KRS

AG Recykling sp. z o.o. NIP

AG Recykling sp. z o.o. REGON

Prodigo Real Estate sp. z o.o.

Metal Trader sp. z o.o.

Metal Trader sp. z o.o. company agreement

Metal Trader sp. z o.o. KRS

Metal Trader sp. z o.o. REGON certificate

Grzybiany Waste sp. z o.o.

Financial Statements

See all the reports of our companies

[reports]

Stock and bond issues

Currently, Prodigo S.A. issues the following shares and / or bonds:

1) N Series Bonds – subscription period from May 22, 2019 to June 27, 2019, planned allocation date, June 28, 2019; To familiarize with the details of the offer, please contact the Investor Relations Department.

2) T series shares – subscription period from April 17, 2019 to June 14, 2019; U series shares – subscription period from May 28, 2019 to July 31, 2019.

Investor’s calendar

- April 17, 2019 – commencement of subscription for series T shares

- May 22, 2019 – commencement of the subscription period for N series bonds

- May 28, 2019 – commencement of subscription for U series shares

- May 31, 2019 – publication of the report: STRATEGIC SUMMARY 2014-2018

- June 14, 2019 – end of subscription for T series shares

- June 27, 2019 – end of subscription for N series bonds

- June 28, 2019 – date of the allotment of series N bonds

- July 31, 2019 – end of subscription for U series shares

- October 21, 2019 – publication of the report for Q3 2019

Informacje podstawowe

PRODIGO Capital Group is a Polish holding company operating in the broadly understood waste management industry, focusing on industrial waste processing.

We operate in an extremely promising market, whose development is essential for the continued existence of our planet. Acting in a sector with high social utility, we pursue a mission of continuous exploration and maximum use of the potentials inherent in waste, which we treat on a par with natural goods. Our motto is: 'PRODIGO — Source of Potential’

Annually, we obtain a stream of more than 250 thousand Mg (tons) of waste, of which 60% returns to the market, after being processed, in the form of products or semi-finished products used in many sectors.

In this way, every day we contribute to reducing the scale of untreated waste and consequently protecting the environment for future generations, according to the circular economy model formulated by the European Union.

Our operations are based on a diversified portfolio of recycling and waste recovery processes, which includes: production of alternative fuels, metal processing, casting of aluminium alloys and processing of rubber and metal waste in the pyrolysis process.

PRODIGO CAPITAL GROUP

The current position of the PRODIGO Capital Group is a result of, among other things, successful market consolidation and implementation of a long-term strategy aimed at achieving the status of a leader in the European waste management market. The above-average pace of the PRODIGO Capital Group’s expansion is confirmed by the fact that Prodigo sp. z o.o. took the fifth place in Poland and the first place in Lower Silesia in the 2017 Forbes Diamonds ranking, which distinguishes companies that increase their value most rapidly.

Since 2018, as a result of ownership transformation processes, the Group is headed by the holding company Prodigo S.A. Six rapidly developing companies with experience dating back to 2007 are responsible for the holding company’s business operations: alternative fuels, metals and castings and pyrolysis.

Team

Tomasz Nietubyć

President of the Management Board of Prodigo S.A.

Piotr Przygoński

CEO

Operations

Jarosław Wróbel

Production and Development Director

Piotr Ginalski

Alternative Fuels Director

Piotr Kotowski

Project Manager – landfill remediation

Administration and support for operating segments

Katarzyna Hoffman-Zyśk

Head of Law and Administration Department

Adam Jaremkiewicz

Head of Finance Department

Przemysław Jacków

Commercial Director